virginia estimated tax payments due dates 2020

Virginia Governor Ralph Northam announced that while filing deadlines remain the same the due date for payment of individual and corporate income tax will now be June 1 2020. Under normal circumstances quarterly estimated tax payments for tax year 2020 would have come due April 15 June 15 and September 15 of this year with the final payment due on January 15 2021.

Benefits Payment Schedule March 2021 April 2021

You have until Monday May 2 2022 to submit your return.

. Virginia 2020 individual returns are now due May 17. Estimated income tax payments must be made in full on or before May 1 2020 or in equal installments on or before May 1 2020 June 15 2020 September 15 2020 and January 15 2021. 2018 Form 760ES.

Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021. File 4th Quarter Virginia Estimated Tax. Individual Income Tax Filing Due Dates.

Due Dates for 2020 Estimated Tax Payments. If the due date falls on a Saturday Sunday or holiday you have until the next business day to file with no penalty. Virginia estimated tax due dates 2021.

Returns are due the 15th day of the 4th month after the close of your fiscal year. Income Tax Return by April 18 2022If you file a tax extension you can e-File your Taxes until October 15 2022 and Nov. If you file Federal estimated payments April 15 is still your due date for the first quarter 2021 estimated tax payment.

At present Virginia TAX does not support International ACH Transactions IAT. At present Virginia TAX does not support International ACH Transactions IAT. If the due date falls on Saturday Sunday or legal holiday you may file your voucher on.

Virginia VA Estimated Income Tax Payment Vouchers and Instructions for Individuals Form 760ES PDF. Any estimated income tax payments that are required to be paid to the Department during the April 1 2020 to June 1 2020 period. When Income Earned in 2020.

Individual Estimated Tax Payments - Virginia. January 10 2022 Beer and Wine Tax. All income tax payments due between April 1 2020 and June 1 2020 including estimated tax payments due April 15 2020 can be made any time on or before June 1 2020 without penalty.

Typically most people must file their tax return by May 1. Virginia 2020 individual returns are now due May 17. The installment due date for Column A is May 1 2020.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. All income tax payments due between April 1 2020 and June 1 2020 including estimated tax payments due. Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. Click IAT Notice to review the details. At present Virginia TAX does not support International ACH Transactions IAT.

First estimated income tax payments for TY 2020. Estimated income tax payments must be made in full on or before May 1 2021 or in equal installments on or before May 1 2021 June 15. January 1 to March 31.

However the Virginia extension to pay while penalty-free is not interest-free. April 1 to May 31. The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter.

The due date for certain Virginia income tax payments has been moved to the deadline of June 1 2020. Let us know in a single click and well fix it as soon as possible. - Virginia Tax is reminding taxpayers in Virginia if you havent yet filed your individual income taxes the filing and payment deadline is coming soon.

Or fiduciary estimated Virginia income tax payments that are required to be paid during. Payment Voucher 1 by May 1 2020. Due dates for 2019 Virginia Estimated Tax are.

Please enter your payment details below. Help us keep TaxFormFinder up-to-date. The District of Columbia has not moved its individual filing deadline.

If you file during the extension period make sure you still pay. January 1 to March 31. Virginia estimated tax payments due dates 2021.

The due date for certain Virginia income tax payments has been moved to the deadline of June 1 2020. See the Estimated Income Tax Worksheet on page 3 of Form 760ES. Is still due April 15.

However the Virginia extension to pay while penalty-free is not interest-free. Due Dates January 15. Virginia has an automatic 6-month extension to file your income tax 7 months for certain corporations.

If you file Virginia estimated. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. Estimated income tax payments must be made in full on or before May 1 2021 or in equal installments on or before May 1 2021 June 15.

Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1. Please enter your payment details below. 2020 Form 760ES Estimated Income Tax Payment Vouchers for Individuals.

Please enter your payment details below. Virginia Sales Tax Guide And Calculator 2022 Taxjar. Individual returns and 2021 first quarter estimated payments are still due April 15.

West Virginia Code 16A-9-1d Sales and Use Tax. Make a Payment Bills Pay bills or set up a payment plan for all individual and business taxes Individual Taxes Make tax due estimated tax and extension payments. Is one of our forms outdated or broken.

Individual and corporate extension payments for TY 2019. No penalties interest or addition to tax will be charged if payments are made by June 1 2020. Individual income taxes Corporate income taxes Fiduciary income taxes and.

When the last day on which a tax return may be filed or a tax may be paid falls on a Saturday Sunday or legal holiday. All income tax payments due between April 1 2020 and June 1 2020 including estimated tax payments due.

Estimated Tax Payments Due Dates Block Advisors

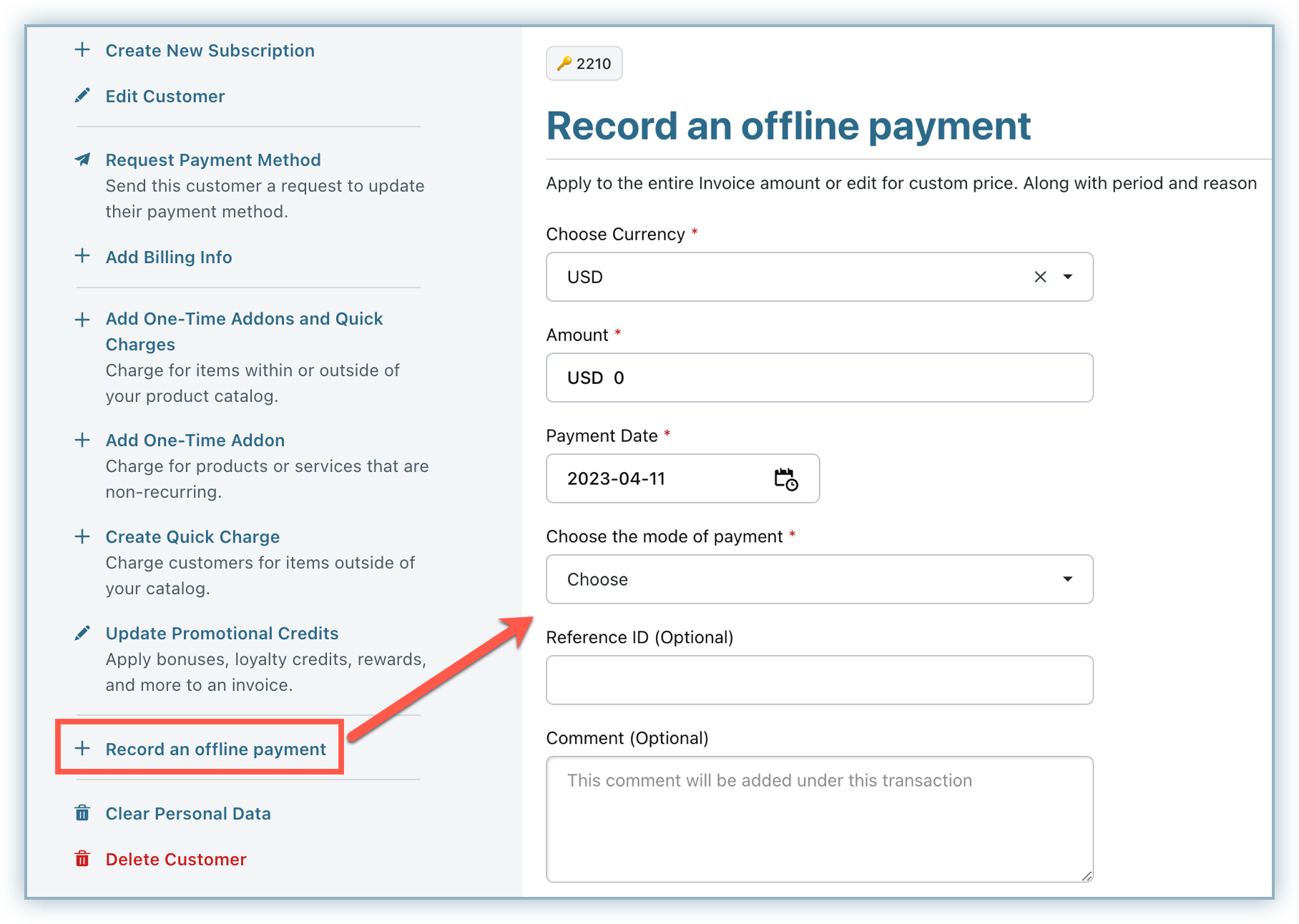

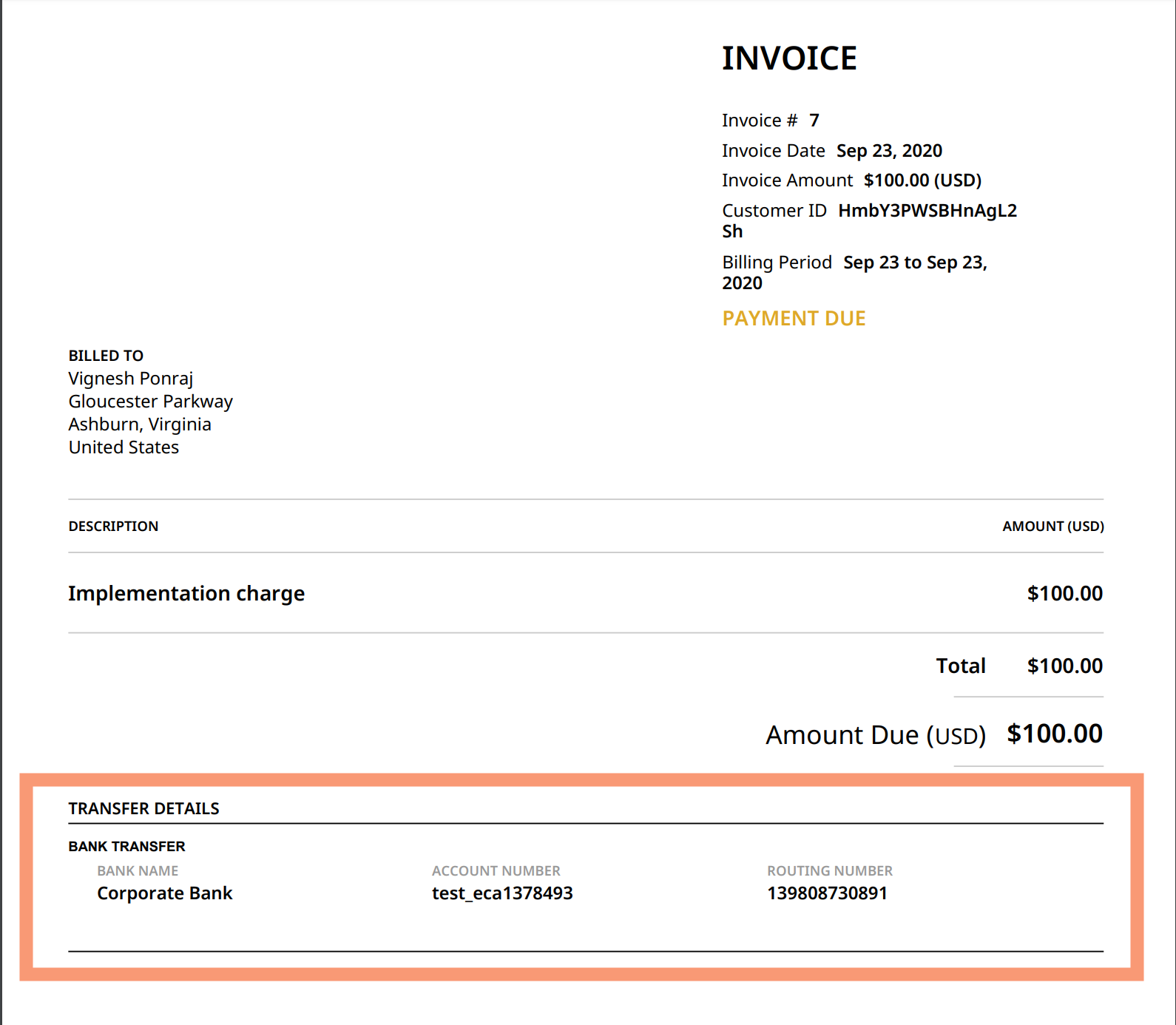

Offline Payments Chargebee Docs

A Survey Of Research On Retail Central Bank Digital Currency In Imf Working Papers Volume 2020 Issue 104 2020

Printable Amortization Schedule Mortgage Calculator With Pmi Amortization Sch Mortgage Amortization Mortgage Amortization Calculator Amortization Schedule

Publication 926 2020 Household Employer S Tax Guide Internal Revenue Service Tax Guide Online Taxes Fun Things To Do

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Quarterly Tax Calculator Calculate Estimated Taxes

Publication 926 2020 Household Employer S Tax Guide Internal Revenue Service Tax Guide Online Taxes Fun Things To Do

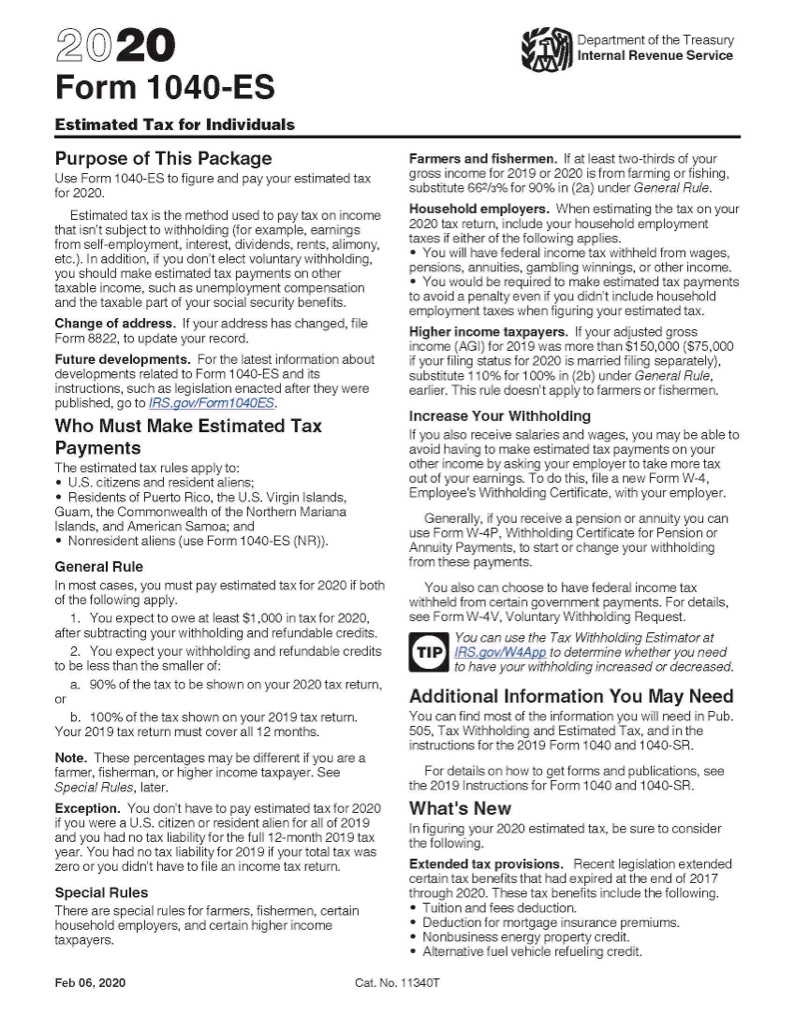

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

Offline Payments Chargebee Docs

Mortgage Calculator You Thinking Of Buying A Home Find Out How Much You Can Afford It Mortgage Amortization Calculator Online Mortgage Mortgage Calculator App

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

The U S Military Is Constantly Advancing In Many Areas Especially When It Comes To Technology In Fact Several Milita Va Mortgages Va Mortgage Loans Va Loan

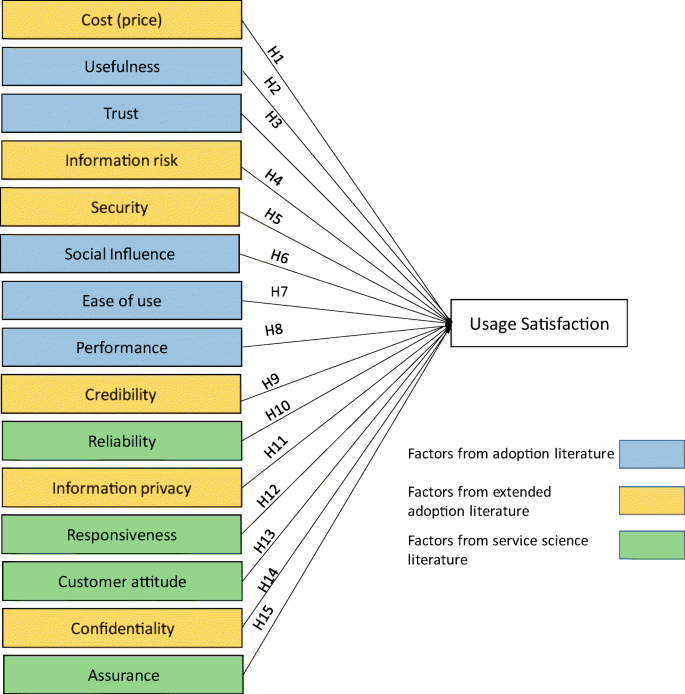

What Affects Usage Satisfaction In Mobile Payments Modelling User Generated Content To Develop The Digital Service Usage Satisfaction Model Springerlink

Fundraising Planning Guide Calendar Worksheet Template Marketing Plan Template Fundraising Marketing Nonprofit Fundraising

7 Steps To Buying A Second Home Re Max Of Ga Remaxga Homebuyer Secondhome Vacationhome Buying First Home Home Buying Tips Home Buying

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

How Much Do I Earn Per Stream On Spotify Igroove Push Your Music

The Hidden Secret To Success As An Entrepreneur Amy Lynn Writing Secret To Success Working Mom Tips Success